The fast-paced digital landscape presents unique challenges for the legal practice, with a surge in case volumes, complex regulations, and the need for quick turnarounds. To meet these demands, you need to embrace cutting-edge technology. Dedicated apps built on the ServiceNow platform offer a promising avenue to enhance productivity, simplify workflows, and foster collaboration among legal professionals.

Corporate legal teams’ adoption of legal tech has gained momentum due to the exhaustion experienced in-house. According to Gartner, many organizations are cautious about increasing the headcount in their legal departments despite the growing workloads these teams face. This has led to a surge in interest regarding legal tech adoption. Gartner’s findings revealed that 68% of corporate legal attorneys struggled to manage their workloads in 2020, and the pressures have only intensified with the rise in business activity since then.

As law firms recognize the need to alleviate the burden on their teams, adopting legal tech solutions becomes increasingly crucial. Building a great app for IoS and Android devices can empower legal teams to navigate the complexities of the digital era while improving efficiency and effectiveness in delivering legal services.

Meeting legal needs in a digital work environment with mobile apps

Legal professionals face many challenges arising from the increasing pace of technological advancements. The traditional methods and processes that once sufficed are no longer adequate to meet the demands of this interconnected era. Legal practitioners require dynamic solutions that adapt to their evolving needs and effectively support their daily tasks. Some of these challenges include the time-consuming nature of administrative tasks, which often distract lawyers from their core legal work. Additionally, the presence of multiple layers of communication and manual handovers can lead to information being lost or delayed, resulting in miscommunication and the potential for errors.

As legal professionals strive to navigate the complexities of a digital work environment and effectively manage client data, it’s imperative to embrace the transformative potential of legal apps. These innovative tools empower legal practitioners to streamline their legal practice, granting easy access to all your documents and enabling seamless completion of tasks on a mobile device. Embracing technology is no longer just a trend but an essential requirement to thrive in today’s fast-paced digital landscape. By harnessing the power of the best apps, which are tailored to the specific needs, legal professionals can overcome challenges, optimize their workflow, and deliver exceptional results for their clients.

Adam Bernaś, Chief Technology Officer – SPOC

How to transform legal workflow with a legal app?

At SPOC, we collaborated closely with our clients within the legal industry to develop dedicated apps, harnessing the robust capabilities of ServiceNow. These apps brought a transformative shift in their operations, eliminating the need for cumbersome paper-based processes. We thought that the best apps should be configured to support the secretarial teams in managing the lifecycle of tasks, reporting, feedback, and capabilities. And that is what we did! We addressed the specific challenges faced by the legal team and revolutionized their workflow:

- Streamlined request assignment: One of the primary pain points for the legal team was the decentralized inbox and service portal. The app provided a centralized mailbox, simplifying and automating the assignment of requests to the appropriate team members. It reduced the likelihood of misfiled tasks, duplication of effort, and missed assignments.

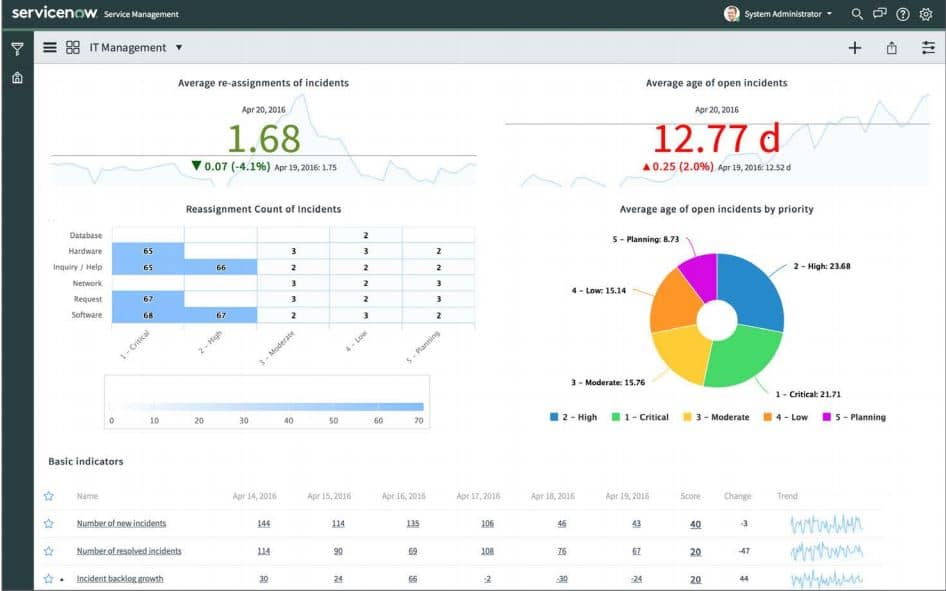

- Real-time task tracking: The app gave lawyers instant access to their tasks and cases, allowing them to track progress and monitor the amount of time invested in each one. This enhanced visibility, improved accountability, and facilitated efficient time management, ensuring that deadlines were met and resources were allocated effectively.

- Seamless communication: Integration with ServiceNow enabled seamless communication between lawyers and secretaries. By eliminating the need for manual handovers and multiple inboxes, the app provided a unified platform for collaboration, allowing swift and accurate transfer of tasks. Consequently, it reduced response times and minimized the impact on Outlook’s performance.

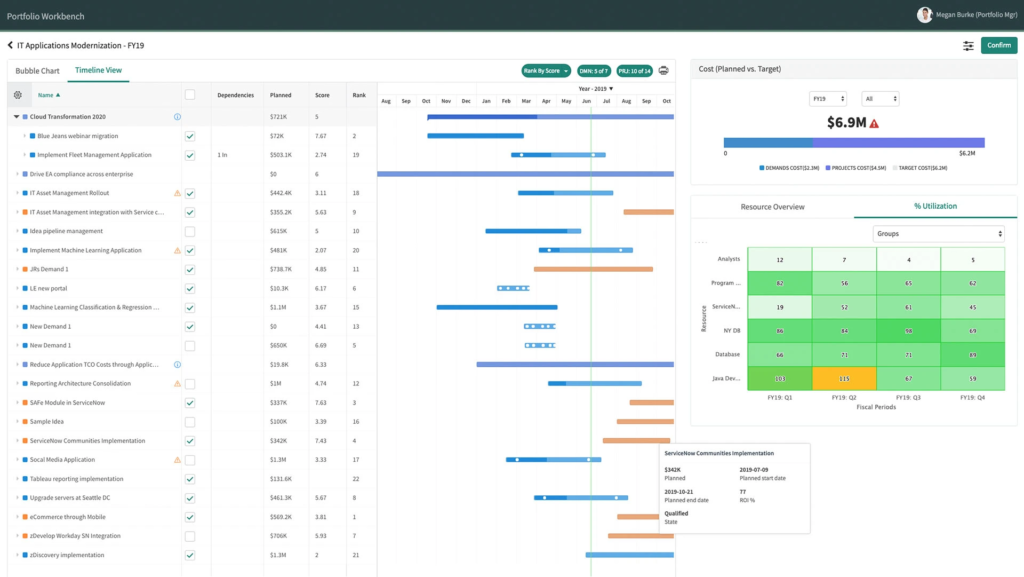

In addition, the app offered several other business benefits for the company. It provided a single portal with customized interactive forms, simplifying the submission process and capturing all necessary information and instructions. Mobile access allowed legal professionals to stay connected and productive while on the move. The app also automated manual processes within the team’s workflows, increasing efficiency and reducing the risk of human error. Management reporting capabilities provided valuable insights into utilization and resource planning, aiding decision-making and optimizing resource allocation.

Revolutionized operations for law firms

Dedicated apps built on ServiceNow can significantly benefit legal teams, including workload allocation, resource visibility, and enhanced efficiency. These apps automate task assignments, streamline processes, and provide real-time information access. By embracing these solutions, law firms gain a competitive edge, improve collaboration, and achieve significant business value in the digital era, being able to solve many problems via mobile phone.

We witnessed the transformative power of legal apps and Service Now in action when our clients, two leading law firms, implemented a tailored app to address their unique challenges. By leveraging this solution, they experienced remarkable improvements in operations and efficiency. With the app accessible on their mobile devices, they were able to effortlessly create documents, complete tasks, manage cases, record time, and add notes, all within a unified platform.

This comprehensive solution provided them with seamless access to vital information, enabling them to resolve cases in a fast manner, organize workflows, and enhance productivity. It’s worth checking out the ability of legal apps built on Service Now as the first step toward optimizing processes and mitigating common issues faced by law firms. By embracing these solutions, legal professionals can create, collaborate, and efficiently manage their work, unlocking a new level of efficiency and productivity.

If you and your legal company recognize the potential of such a solution, we invite you to contact us. As experts and an Elite Partner of ServiceNow, we have the expertise and experience to assist you in implementing and leveraging these dedicated apps to transform your legal operations. Contact us today at sales@spoc.eu to schedule a demo and explore how we can empower your team and drive greater organizational efficiency.